In aremarkable budget speech,Uganda government has granted business startups three-year income tax holiday effective July 1, 2025,

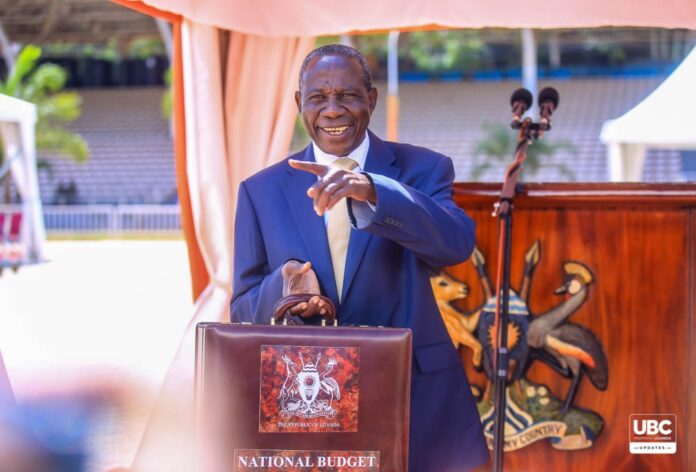

Finance Minister Matia Kasaijja says the reforms will support local entrepreneurship and formalization of the fast growing East African economy.

Presenting the Shs 72trillion FY2025/26 National Budget on at Kololo Ceremonial Ground,Kasaija noted that the tax exemption targets start-ups that typically face high upfront investment costs and low cashflows in their formative years.

“This is intended to foster innovation, encourage formalisation of SMEs, enhance business survival, and promote employment,” the Minister told Parliament.

The development comes at a time when Uganda’s start-up ecosystem has expanded rapidly in recent years, with growing numbers of young entrepreneurs entering the informal sector. However, most operate as sole proprietors and often avoid formal registration due to compliance costs and tax obligations.

“By offering this three-year tax relief, the government aims to reduce early financial pressures on new businesses and incentivize formalization, especially in sectors like agro-processing, technology, retail, and light manufacturing,”Kasaijja explained

The policy, experts say, is expected to benefit thousands of Ugandan innovators and small-scale investors, providing them with a stable financial runway to scale their ventures and create jobs.

Alongside the tax holiday, Kasaija also announced that the government has scrapped capital gains tax on asset transfers where an individual moves their assets into a company they own or control. He explained that many Ugandans who seek to formalize their businesses by registering companies often face a punitive capital gains tax when transferring personal assets into the newly formed entity, which has been a major deterrent to business formalization.

“When these individuals seek to transition into more formal and structured corporate entities for growth, access to finance, or succession planning, they face a capital gains tax liability simply for transferring their assets into a company they fully own. This tax burden has now been removed,” Kasaija stated.